Rose Hill

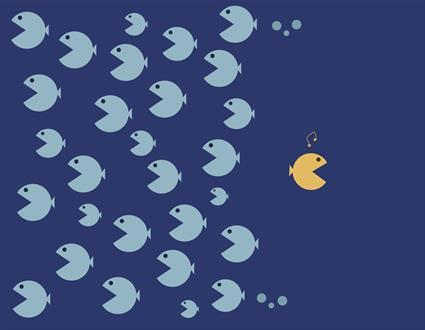

Dare to be different: six ways to fund your small business without heading to the bank

Looking for alternative ways to fund your business can be very worthwhile.

Going to the bank for funding is not a necessity, and is certainly not the only avenue to buying and running your own business.

Here are six alternative ways to fund your enterprise:

Financial DIY

Do it yourself: invest in you from the start. When the business you want to buy is just an idea, save up through your current job and work hard to work for yourself.

Offer to work extra time, which often pays more, and do as much as you can to reach a target so you can buy your business.

A bit on the side?

The ability to multi-task is a necessity in running a business, so why not in funding it too?

There are a multitude of ways that you could earn some money on the side to enable you to run your new business, for example:

- Running a side business, which acts as a funding tool for the other. Also known as ‘double dipping.’

- Renting a room out – if you’re lucky to have a mortgage on a flat, maybe rent out a spare room and gain some extra revenue.

- Lease your expertise out and do a bit of freelance – copywriting, photography, graphic design for example.

Safety in numbers

While crowdfunding is generally aimed at potential start-ups, many business owners have used the process to help them out in the early stages of taking over the reins or when in financial trouble.

There are many websites that offer the service, where companies make an online pitch for money from members of the public. In return, investors can be given anything the business wants to, from a simple thank you to an equity stake.

Some great websites for business crowdfunding are: crowdcube, InvestingZone and SyndicateRoom.

Seller financing

This variation of financing involves the seller of a business providing a loan to the person purchasing it. Initially, the buyer will make a down payment, which is then followed by installment payments priorly agreed upon by both parties over a specified amount of time.

The terms of a deal made via seller financing should be specified within a legally binding purchase agreement, which has been drawn up by the help of an attorney and signed by the buyer and seller.

Lease purchase/ Profit-share

If you are unable to buy certain products that you need outright for your business, then it may be worth organising a lease purcase or profit share arrangement.

Lease purchasing involves a supplier who, rather than asking for the whole sum at once, will charge a high weekly rental figure at around 50% or more. After a certain amount of time, you will have paid for it and be the full owner.

Profit sharing, on the other hand, is reliant on the takings that the product brings in each month. An external supplier will own and maintain the equipment after charging an initial installment fee, taking 50% of its takings each month. For the early stages of the business this is a safer option, however at a later date when your business is busier you could be paying a massive chunk of your earnings to the supplier.

Minimise spend in the first place

Buying a company that requires a minimal spend in the first place will inevitably save you money.

It could be a service-based company involving only your own skills from the beginning, or even an internet company that enables you to work at home. This would mean that you wouldn’t need to spend money on office rent, nor product costs.

Family and friends

These are most likely the first people you’ll talk to about wanting to own your own company.

Unlike other investors, they probably won’t grill you about seeing figures, graphs and plans (though it would be a good idea if you could provide them with some).

Any loans given to you should be written down as either promissory notes or bridge-loans, which will be converted into equity at a later date.

Peer-to-peer lending

Peer lending can also be used effectively when small business groups come together to lend money to each other. This is often an alternative to going through a traditional financial intermediary, such as a bank.

This type of lending is made to an individual, rather than a company, and are known as unsecured personal loans. These are often done via websites that match individual borrowers with other peers willing to put money away for a good return.

However, peer-to-peer lending on websites is now regulated by the Financial Conduct Authority, whose rules now state that peer-to-peer firms must be honest about the risks of investing money, present information regarding the company clearly and must have a fully thought-out system or procedure if something were to go wrong.

RELATED ARTICLES

How to Get People to Remember Your Business Name

Everyone wants to be remembered. When someone says your name, it’s a magic that canRead More

Funding Circle Raises $65 Million for Peer-to-Peer Small Business Loan

Venture capital firms have come to see small business lending as an industry ripe forRead More

Comments are Closed